The allure of the open sea, the promise of exotic destinations, and the luxury of a floating

The allure of the open sea, the promise of exotic destinations, and the luxury of a floating hotel – cruising has long been a favoured mode of travel for many. But what happens when the voyage takes an unexpected turn, not due to turbulent waters but because of phantom taxes being charged to passengers making Millions of pounds for NCL?

The allure of the open sea, the promise of exotic destinations, and the luxury of a floating hotel – cruising has long been a favoured mode of travel for many. But what happens when the voyage takes an unexpected turn, not due to turbulent waters but because of phantom taxes being charged to passengers making Millions of pounds for NCL?

Enter the world of NCL Cruise Line, a renowned name in the industry, and a seasoned traveller with a keen eye for detail and a background in the travel industry.

This isn’t a tale of missed ports or onboard mishaps but a journey through the intricate maze of travel regulations, consumer rights and what appears to be phantom tax charges.

Our “Detective” with 25 years in the travel industry, was no stranger to the nuances of the Package Travel Regulations. So, when unexpected charges started appearing on her bills during her recent NCL cruise, she knew something was amiss.

The charges?

Tax on drinks consumed from a pre-paid package on which Government taxes had already been paid in the UK before her departure.

A minor detail for some, but a glaring inconsistency for our well-versed traveller, and a windfall of millions of pounds for NCL cruise line. We estimate approx. £10-15,000,000

NCL’s Booking Confirmation, as per our “detectives” account, appeared to be in direct violation of the Package Travel and Linked Travel Arrangements Regulations 2018. And also the Consumer Rights Act 2015 and Unfair Terms in Consumer Contracts Regulations 1999.

These regulations, specific to the UK, are crystal clear:

Where the relevant person provides to the traveller the information specified in paragraphs 1 to 10, 12 to 14 and 16 of Schedule 1, that information—

- (a) forms an integral part of the package travel contract, and

- (b) must not be altered unless the traveller expressly agrees otherwise with the relevant person, as the case may be.

(2) The relevant person must communicate to the traveller any change to the information provided under Regulation 5, in a clear, comprehensible, and prominent manner before the conclusion of the package travel contract.

(3) Where, before the conclusion of the package travel contract, the relevant person does not provide the information which is required to be provided under paragraph (1) in respect of additional fees, charges or other costs referred to in paragraph 12 of Schedule 1 the traveller is not required to bear those fees, charges or other costs.

(4) It is an implied condition (or, as regards Scotland, an implied term) of the package travel contract that the relevant person complies with the provisions of this regulation.

(5) In Scotland, any breach of the condition implied by paragraph (4) is deemed to be a material breach justifying rescission of the contract.

So, what The Package Travel and Linked Travel Arrangements Regulations 2018 appear to me to be saying is that you have to advise the traveller before the completion of the contract all the charges and fees they can expect on board.

“The total price of the package inclusive of taxes and, where applicable, of all additional fees, charges, and other costs or, where those costs cannot reasonably be calculated in advance of the conclusion of the contract, an indication of the type of additional costs which the traveller may still have to bear.”

Drawing from her extensive experience, our “detective” embarked on a mission to rectify the oversight. By now, many passengers were in conflict with the cruise company, and mutiny was in the air. She wasn’t alone in her quest.

Many passengers had faced similar charges, but few had the tenacity or knowledge to challenge them. The cultural divide between the US and the UK became evident.

While American passengers often accepted these charges as is par for the course, our UK traveller knew her rights and was determined to ensure they were upheld.

The journey wasn’t smooth sailing. Initial complaints on board were met with understanding but no resolution.

Emails to NCL’s guest services were met with evasive responses. But perseverance, backed by a solid understanding of the law, eventually led to a breakthrough. The ABTA complaints procedure, a beacon for travellers seeking justice, became the platform for her voice to be heard. The outcome? A triumph for consumer rights.

Not only was the tax refunded, but the case also shed light on a more significant issue – the potential misinterpretation of regulations by cruise lines, leading to unjust charges for thousands of passengers.

This tale serves as a beacon for travellers everywhere. It’s a testament to the power of knowledge, the importance of consumer rights, and the belief that even the choppy waters of travel regulations can be navigated successfully with perseverance.

So, the next time you set sail on a cruise, remember this tale.

Know your rights, stand firm, and ensure your voyage is as smooth as the tranquil seas. Safe travels!

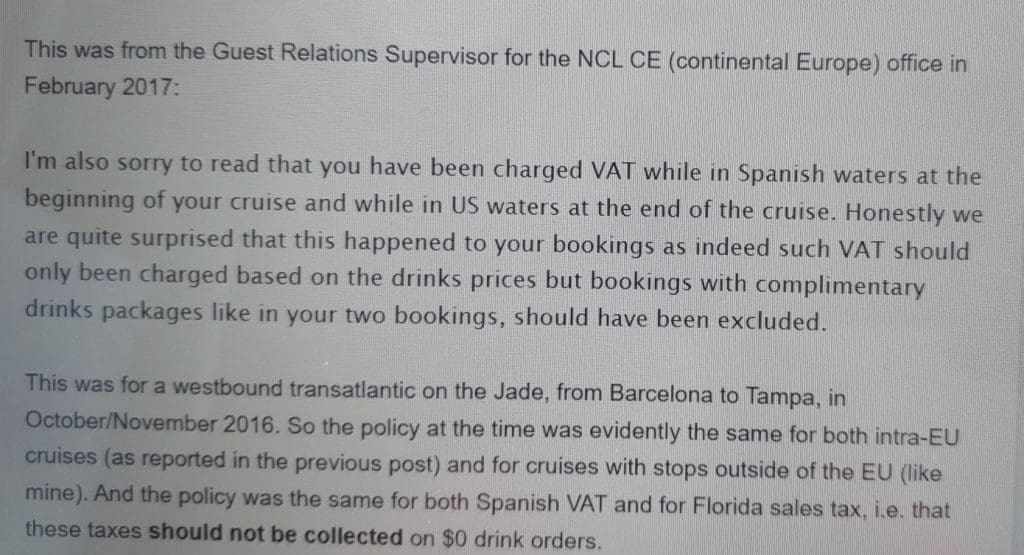

If proof was needed, here is a response from NCL about the same issue in 2016

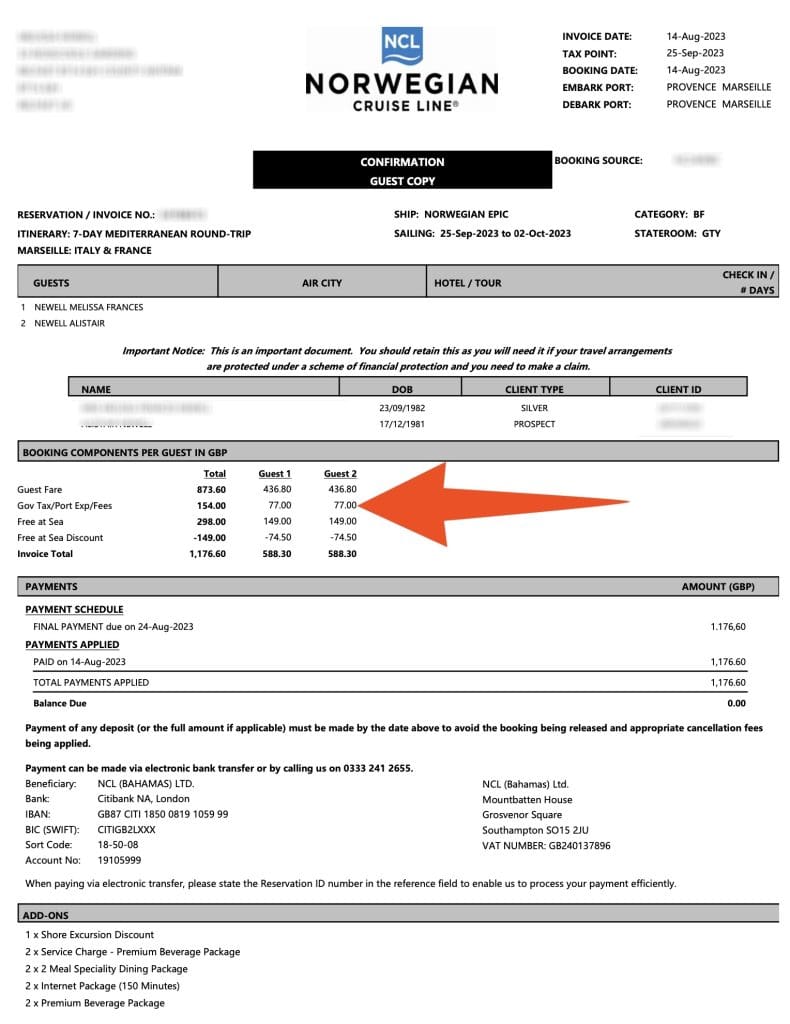

and another in 2023

and another in 2023

We have written to NCl requesting clarification, as yet, we have heard nothing.